Management Base that Supports Earning Power

We have long adopted the basic policies of maintaining and strengthening a diversified business portfolio, and keeping a balance between risk-adjusted assets and the risk buffer. As we head toward fiscal 2019, we envision an even higher level of profit growth. BBBO2014 is guiding our efforts to reach this goal by thoroughly enhancing our earning power. As a measure to strengthen the management base that supports our earning power, we are working to maintain financial soundness and strengthen management abilities on business investment.

Maintain Financial Soundness

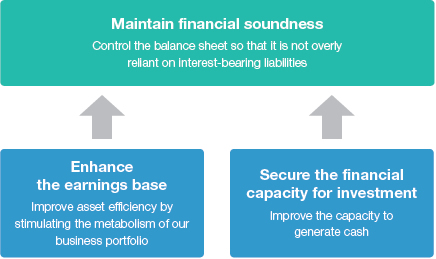

In recent years, a tumultuous financial environment has become the rule rather than the exception, as evidenced by the financial crisis precipitated by the Lehman Brothers bankruptcy, the European debt crisis and other events. Consequently, financial institutions are facing an increasingly strict regulatory environment. In this financial landscape, it is imperative that we control our balance sheet so that it is not overly reliant on interest-bearing liabilities.

Two measures will be vital to maintaining a sound financial structure that does not depend too much on interest-bearing liabilities, and achieving an even higher level of profit growth. First, we must enhance our earnings base by improving asset efficiency. Second, we must secure the financial capacity for investment by improving our capacity to generate cash.

1. Enhance the Earnings Base (Stimulate the Metabolism of our Business Portfolio)

Under BBBO2014, we are working to stimulate the metabolism of our business portfolio from a medium-to-long term perspective in order to thoroughly enhance our earning power. This will entail making effective use of limited corporate resources in conjunction with adding ROA to our quantitative targets.

We will continue to replace assets in our portfolio by shifting from businesses that show little potential for profit or growth to businesses which we have strengths in and that are to remain our earnings pillars in the future, and businesses that have prospects for growth over the medium to long term and that are to be fostered and developed as our new earnings pillars in the future. At the same time, we will steadily raise the value of the projects we have invested in.

In certain cases, we may expect to drive higher growth by harnessing the knowledge and expertise of other companies, rather than conducting businesses independently. Here, we will expand our business by forming alliances with strategic partners, while properly managing the balance sheet. In fiscal 2013, we joined forces with Osaka Gas Co., Ltd. by selling half of our shares in a wholly owned U.K. water supply company to this new partner. Through its public utility business, Osaka Gas has developed expertise in areas such as customer service, and operation and maintenance. By integrating this expertise with our experience in the water and sewage treatment business, we are striving to further enhance our business base.

2. Secure the Financial Capacity for Investment

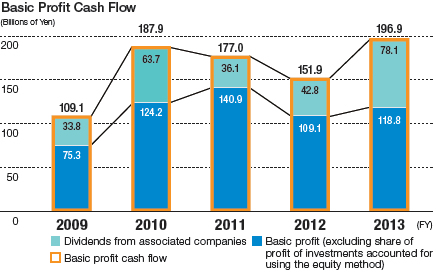

Under BBBO2014, we have begun monitoring basic profit cash flow* in order to improve our capacity to generate cash. Through this process, we are pushing ahead with recovering earnings through cash. We will also continue working to collect cash by realizing the value of certain assets, and by divesting businesses with low profitability or low prospects for growth. In the process, we will secure the financial capacity for investment as we continue to invest in growth.

- * Basic profit cash flow = Basic profit - Share of profit of investments accounted for using the equity method + Dividends from associated companies

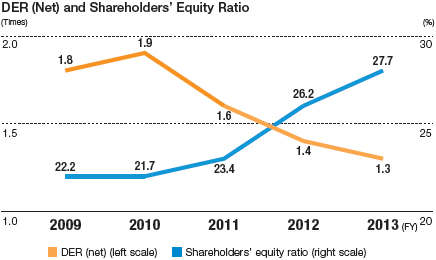

As a result of such endeavors to maintain financial soundness by enhancing our earnings base and securing the financial capacity for investment, our net debt-equity ratio (DER) was reduced to 1.3 and the shareholders' equity ratio stood at 27.7% as of March 31, 2014.

Strengthen Management Abilities on Business Investment

We have made business investments in many different fields. Our investments include those that require substantial sums of investment and those that are exposed to a relatively high degree of risk, notably investments in the manufacturing sector and resource and energy interests. Strengthening our business investment management abilities is a crucial priority for ensuring that we raise the value of these investments and have them contribute to earnings.

Under BBBO2014, we have reinforced our system to ensure that Business Units and Corporate Group collaborate and follow up on large business investments, in addition to implementing pre-existing investment risk management* approaches. We form project teams for each project and have a system in place to provide integrated support ranging from the stages of studying the feasibility of potential investments to launching businesses after investments have been executed. We also have a system in place where the Loan and Investment Committee takes the lead in intensively monitoring and exploring the necessary countermeasures with respect to projects that need to be addressed in some way or another, due to changes in the operating environment and other factors.

Considering our experience with business investments in the past, we are also systematically organizing a range of issues and solutions across the entire process related to business investment, in an effort to enhance the quality of the overall business investment process and enhance investment performance throughout the Company.

Pre-existing Measures

Maintain and Strengthen a Diversified Business Portfolio

Assets that are concentrated in a specific field or region are exposed to the risk of tremendous loss that could be incurred due to changes in the business environment or the materialization of country risk in the host country of an investment project.

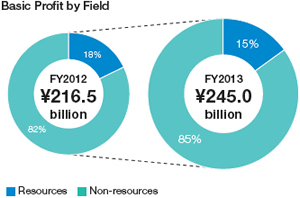

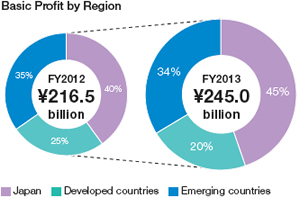

While working to efficiently allocate limited corporate resources, we believe that avoiding any over-concentration of business portfolio assets is crucial to ensuring the stability of our business. Guided by this belief, we have been working to build a diversified portfolio in the course of expanding businesses in many different fields and regions. In terms of business fields, we have been bolstering non-resources fields in a well-balanced manner without overly relying on profits from resource fields, and by region, we have been maintaining balanced earnings streams from Japan, developed countries and emerging countries, thereby building a diverse earnings structure.

Under BBBO2014, there has been no change to this policy. We will continue to maintain a diversified business portfolio as we strive to expand our earnings base.

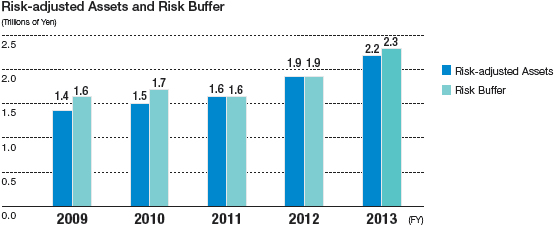

Keep a Balance between Risk-adjusted Assets and the Risk Buffer

We introduced risk-adjusted return management as a fundamental principle of management in 1998. Guided by this principle, we strive to keep a balance between risk-adjusted assets which are our maximum possible loss and the risk buffer which is our shareholders' equity. This principle means that even if all potential risks were to actually occur at once, shareholders' equity would be able to absorb the losses and keep the Company in business.

Our risk-adjusted assets have been on an upward trend, reflecting the increasing innovation of our business models, as exemplified by our participation in resource and energy development projects and the manufacturing sector. We have been properly controlling the level of risk-adjusted assets along with increasing our risk buffer by accumulating profit for the year. As a result, we have kept a balance between risk-adjusted assets and our risk buffer.