- Structures to Support Business Activities

-

- Corporate Governance

- Sumitomo's Business Philosophy / Sumitomo Corporation Group's Corporate Mission Statement

- Corporate Governance System

- Internal Control and Internal Audits

- Compliance

- Risk Management

- Human Resource Management

- Towards a Better, Sustainable Society (CSR)

- Message from the Chair of the CSR Committee

- Environmental Initiatives

- Social Initiatives

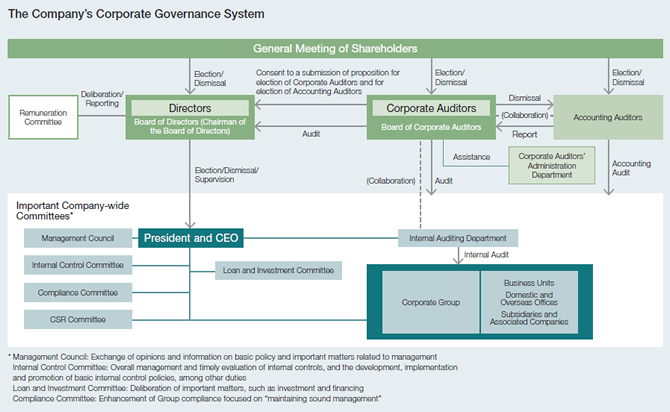

Corporate Governance System

We believe that the ultimate goals of corporate governance are "improving management efficiency" and "maintaining sound management" as well as "ensuring management transparency" to achieve the first two goals. Based on this belief, we are working to establish a corporate governance system that serves the interests of shareholders and all other stakeholders.

- Our approach to corporate governance is embodied in the "Sumitomo Corporation Corporate Governance Principles," which can be accessed from the following web page.

Sumitomo Corporation Corporate Governance Principles (125KB/PDF)

Features of Our Corporate Governance System

We have adopted a corporate auditor system, believing that it is the most legitimate means of improving the effectiveness of our corporate governance to enhance and reinforce it through auditing from diversified external viewpoints. We have five Corporate Auditors, three of whom are Outside Corporate Auditors. Of these three, two are legal experts (a former President of the Tokyo High Court and a former Prosecutor-General) and one is an accounting expert — ensuring an auditing system that incorporates a diversity of perspectives. Furthermore, two Outside Directors were elected at the 145th Ordinary General Meeting of Shareholders held on June 21, 2013 so that through their diverse perspectives, the Outside Directors help to ensure appropriate decision-making in board meetings and further enhancement of the supervisory function. We believe that we can achieve the ultimate goals of corporate governance by reinforcing management oversight by independent Outside Directors and Outside Corporate Auditors.

Based on "Sumitomo's Business Philosophy," we have established the Sumitomo Corporation Group's Management Principles and Activity Guidelines, and work to enforce these principles and guidelines among all officers and employees, in order to share the basic values that must be respected by the Sumitomo Corporation Group, including compliance with laws and regulations.

From the perspective of maintaining sound management, we have developed a system for ensuring compliance with laws and regulations by establishing a Compliance Committee and introducing a "Speak-Up System" for internal reporting, among other measures. Guided by the belief that management itself must conduct its duties with high ethical standards, we have clearly stated in the "Sumitomo Corporation Corporate Governance Principles" that in principle, the term of office for the Chairman of the Board of Directors and the President and CEO are each limited to six years in total.

Framework for "Improving Management Efficiency" and "Maintaining Sound Management"

Directors and the Board of Directors

Optimization of Size of Board of Directors

We halved the number of Board members from 24 in 2003. As of July 2014, the Board has 12 members. Through this optimized Board of Directors, which oversees the operations of the business and serves as the Company's decision-making body concerning key management matters, we aim to facilitate substantial and active discussion as well as to promote greater efficiency and effectiveness in the decision-making process.

Limiting Term of Office for Directors

In June 2005, the term of office for Directors was reduced from two years to one year. We aim to clarify the responsibility of management among members of management each fiscal year. This, in turn, helps ensure fast reaction times to changes in business conditions.

Limits on Term of Office for the Chairman of the Board of Directors and the President and CEO

In principle, the positions of Chairman of the Board of Directors and the President and CEO are clearly defined and separate in order to ensure mutual supervision and both positions cannot be held simultaneously by one person. In principle, the term of office for the Chairman of the Board of Directors and the President and CEO are each limited to six years in total. These limitations on the tenure of top management help minimize the possibility of governance problems.

Establishment of the Advisory Body to the Board of Directors

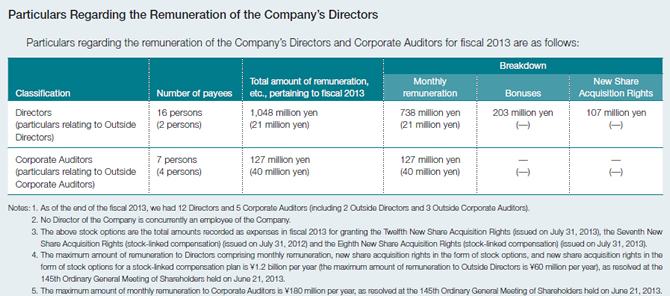

With the aim of enhancing the transparency and objectivity of decision-making processes with regard to the remuneration of Directors and Executive Officers, we established the Remuneration Committee. Functioning as an advisory body to the Board of Directors, no fewer than half of the Committee members are from outside the Company. The Remuneration Committee is in charge of studying remuneration and bonuses of Directors and Executive Officers, and reports the results of its studies to the Board of Directors.

Election of Outside Directors

For the purpose of Sumitomo Corporation ensuring appropriate decision-making in board meetings and further enhancement of supervisory functions through diverse perspectives, two Outside Directors were elected at the 145th Ordinary General Meeting of Shareholders of Sumitomo Corporation held on June 21, 2013. They fulfill the standards related to independence set by Tokyo Stock Exchange, Inc. and other financial instruments exchanges that Sumitomo Corporation is listed on, and Sumitomo Corporation has notified the exchanges, under their respective provisions, of their respective status as independent director.

Reason for selection and brief outline of career of the Outside Directors are as follows:

Akio Harada

Reason for selection

Akio Harada is deemed to be qualified for the role of Outside Director because he possesses highly specialized knowledge accumulated over many years as a prosecutor and lawyer, and a wealth of practical experience and on the grounds of his character and insight, and was therefore elected to the post.

Brief outline of career

- December 1999 Superintending Prosecutor, Tokyo High Public Prosecutor's Office

- July 2001 Prosecutor-General

- October 2004 Attorney at Law (present position)

- June 2005 Outside Corporate Auditor, Sumitomo Corporation

- June 2013 Outside Director, Sumitomo Corporation (present position)

Kazuo Matsunaga

Reason for selection

Kazuo Matsunaga is deemed to be qualified for the role of Outside Director because he held a series of important posts over many years at the Ministry of Economy, Trade and Industry and possesses broad knowledge and experience in fields including resources, energy, and industrial policy and on the grounds of his character and insight, and was therefore elected to the post.

Brief outline of career

- July 2008 Director-General, Economic and Industrial Policy Bureau

- July 2010 Vice-Minister of Economy, Trade and Industry

- June 2013 Outside Director, Sumitomo Corporation (present position)

Corporate Auditors and the Board of Corporate Auditors

Enhancement of Corporate Auditing Framework

To further strengthen external views within the corporate auditing framework, we added one external auditor in June 2003, bringing the number of external auditors to three out of the five members on the Board of Corporate Auditors. Of these three, two are legal experts (a former President of the Tokyo High Court and a former Prosecutor-General) and one is an accounting expert—ensuring an auditing system that incorporates a diversity of perspectives. The three external Corporate Auditors fulfill the standards related to independence set by Tokyo Stock Exchange, Inc. and other financial instruments exchanges that Sumitomo Corporation is listed on, and Sumitomo Corporation has notified the exchanges, under their respective provisions, of their respective status as independent auditors.

Ensuring Audit Effectiveness

Corporate Auditors attend meetings of the Board of Directors and all other important internal meetings, to obtain the information necessary for proper auditing. Corporate Auditors also meet with the Chairman of the Board of Directors and the President and CEO every month to exchange opinions on material issues regarding management policy and auditing. Moreover, the Corporate Auditor's Administration Department is assigned to assist Corporate Auditors, so that the auditing system functions effectively and without hindrance.

Reason for selection and brief outline of career of the Outside Corporate Auditors are as follows:

Tsuguoki Fujinuma

Reason for selection

Tsuguoki Fujinuma has a broad range of expertise, including on matters of finance and accounting, and long years of experience as an accountant. He was selected and asked to perform audits from a broad perspective on the grounds that his character and insight are most suited for the position.

Brief outline of career

- June 1993 Representative Associate, Ota Showa Audit Corporation (now Ernst & Young ShinNihon LLC)

- May 2000 President, International Federation of Accountants (IFAC)

- July 2004 Chairman and President, The Japanese Institute of Certified Public Accountants

- July 2007 Advisor, The Japanese Institute of Certified Public Accountants (present position)

- June 2008 Outside Corporate Auditor, Sumitomo Corporation (present position)

Mutsuo Nitta

Reason for selection

Mutsuo Nitta has a broad range of expertise and long years of experience as both a judge and lawyer. He was selected and asked to perform audits from a broad perspective on the grounds that his character and insight are most suited for the position.

Brief outline of career

- December 2004 President of the Tokyo High Court

- April 2007 Attorney at Law (present position)

- June 2009 Outside Corporate Auditor, Sumitomo Corporation (present position)

- October 2012 Chairman of Tokyo Metropolitan Public Safety Commission

Haruo Kasama

Reason for selection

Haruo Kasama has a broad range of expertise and long years of experience as both a prosecutor and lawyer. He was selected and asked to perform audits from a broad perspective on the grounds that his character and insight are most suited for the position.

Brief outline of career

- June 2010 Superintending Prosecutor, Tokyo High Public Prosecutor's Office

- December 2010 Prosecutor-General

- October 2012 Attorney at Law (present position)

- June 2013 Outside Corporate Auditor, Sumitomo Corporation (present position)

Collaboration Between Internal Auditing Department and Accounting Auditors

To ensure audit efficiency, Corporate Auditors interact closely with the Internal Auditing Department, receiving reports on internal audit plans and their results in a timely manner. In addition, Corporate Auditors exchange information with and monitor the auditing activities of the Accounting Auditors through regular meetings. By attending audit review meetings with the Accounting Auditors and observing inventory audits, the Corporate Auditors constantly work to improve audit efficiency and quality.

Furthermore, Corporate Auditors attend meetings of the Internal Control Committee and request reports on the status of internal control systems from other departments responsible for internal control, along with their cooperation on audits.

Introduction of an Executive Officer System

We have introduced an executive officer system with the aim of clarifying the responsibilities and authority for execution and strengthening the monitoring function of the Board of Directors. We currently have 43 Executive Officers (as of July 31, 2014) selected by the Board of Directors. Of these, nine Executive Officers also serve concurrently as Directors, including five who are also General Managers of Business Units. In this way, we aim to prevent gaps between decisions made at Board of Directors meetings and the execution of those decisions.

Message from an Outside Director

Kazuo Matsunaga

Outside Director

Appointed as Outside Director of Sumitomo Corporation in 2013 after previous positions including being the Director-General of The Economic and Industrial Policy Bureau and Vice-Minister of Economy, Trade and Industry.

One year has passed since my appointment as an Outside Director of Sumitomo Corporation. Having spent many years working at the Ministry of Economy, Trade and Industry (METI), I thought I knew well the business undertaken by integrated trading companies, but I have been given a new awareness of many aspects since I began taking part in decision making with the Board of Directors. To be specific, the evolution to investment-type business models has moved forward more than I thought, and the extent of business handled is vast.

While at the METI, we mainly drew up plans with the idea of how substantially our plans would benefit the national wealth and what policies were needed to fulfill the plans, after which we would entrust the private sector with implementing the plans. I went from being in this position to becoming a Director for Sumitomo Corporation, itself a private company, and in the position of discussing specific businesses.

Sumitomo Corporation employees act in a manner that is prideful for the country or world, feel they should raise their performance and are particular, I believe, about taking the correct process and doing a wonderful job. Their conduct when it comes to methods of decision making conveys an impression of being solidly rounded. They firmly quantify items like investment risk, and involvement in thorough discussions leaves a favorable impression.

On the other hand, it is extremely difficult to achieve a balance between risk management and maximizing earning power. The Board of Directors must be adept at controlling that balance. Discussion about risk is of course necessary, but I think it is also my role as an Outside Director to push to take on the challenge of grasping business opportunities.

Sumitomo Corporation is engaged in many large-scale projects of the type that support the implementation of national-level plans. Based on my own experiences, the business model of the integrated trading company is one that people inside Japan and overseas should focus on. I would like Sumitomo Corporation employees to utilize people, products and services and capital, have pride, and feel at ease while working.

Message from an Outside Corporate Auditor

Haruo Kasama

Outside Corporate Auditor

Appointed as Outside Corporate Auditor of Sumitomo Corporation after previous positions including being the Superintending Prosecutor of the Tokyo High Public Prosecutor's Office and Prosecutor-General. Currently, he is also an Attorney at Law.

Corporate auditors have a responsibility to monitor whether directors are acting illegally and ensure that does not harm the company. One year has passed since becoming an Outside Corporate Auditor of Sumitomo Corporation, and in that time, I have not been aware of any incident that may have caused me to worry on these points.

Sumitomo Corporation's corporate governance is effective and it is a steady company. The Sumitomo Corporation Group has Sumitomo's Business Philosophy, which functions as an axis for corporate governance.

Sumitomo Corporation invests in a variety of companies and, in addition to operating income, the earnings of investees also carry significant weight. Regarding investments, there is lively and solid debate in meetings of the Board of Directors about their risks and return on investments over the medium to long term. It is at these times when I strongly feel the dissemination of compliance and Sumitomo's Business Philosophy of "integrity," "sound management" and "no pursuing easy gains."

I worked for a long time at the Public Prosecutor's Office, during which I associated with people from a variety of backgrounds, but what I felt strongest was "the importance of trusting relationships." Trust built up once should not be allowed to simply shake. Relationships built on trust have proved beneficial to me in a variety of situations. Integrated trading companies also find it extremely important to build relationships of trust with customers. Business solely focused on profit will not build relationships of trust. Corporate auditors are a checking institution and do not have voting rights at meetings of the Board of Directors and I believe they should not infringe on the discretionary powers of directors making management decisions. However, while respecting discretionary powers to the maximum extent, we must check for unfair methods that run counter to having a trusting relationship with customers.

Sumitomo Corporation operates on an enormous scale and is a company with an extremely significant social mission. Going forward, I want it to be profitable for the state and society and develop business connecting to its value creation while maintaining relationships of trust with customers.

System for Ensuring Management Transparency

Basic Policy on Information Disclosure

To bring an accurate understanding of the Company's management policies and business activities to all our stakeholders, we shall strive to make full disclosure, not limiting ourselves to the disclosure of information required by law but also actively pursuing the voluntary disclosure of information.

Communicating With Shareholders and Other Investors

Encouraging the Execution of Voting Rights at the General Meeting of Shareholders

We send out a Notice of Convocation to shareholders three weeks prior to each regularly scheduled General Meeting of Shareholders. For the convenience of overseas shareholders, we also provide an English-language translation of the notice on our website. We have allowed our shareholders to exercise their voting rights via the Internet using personal computers since 2004 and via the Internet using mobile phones since 2005. In 2007, we introduced the Electronic Voting Platform operated by Investor Communication Japan, Inc. (ICJ), instituted by Tokyo Stock Exchange, Inc. and others. The new platform allows institutional investors sufficient time to thoroughly examine the propositions to be resolved at the meeting.

Disclosure of Various Information

Our corporate website endeavors to ensure the provision of proactive and timely disclosure of various documents and materials containing information that may be useful in making investment decisions. These documents and materials include financial results, yukashoken houkokusho (Japanese annual securities reports), and the Company's presentation materials. Moreover, the website provides Sumitomo Corporation's Annual Report. The website also presents features compiled to introduce Group-wide topics such as the projects the Company operates all over the world.

Investor Relations

In addition to working to enhance the disclosure of information on our website, in order to ensure direct communication with shareholders and other investors, we hold quarterly meetings to provide information on our financial results for analysts and institutional investors. For overseas investors, we periodically visit the United States, the United Kingdom, and other countries in Europe and Asia to hold one-on-one meetings with investors in each region. In addition, in fiscal 2004, we began regularly holding meetings with individual investors in Japan. In fiscal 2013, we held five such meetings in four cities, attended by a total of 1,100 individual investors.

While working to strengthen and enhance our corporate governance structure and systems, from the perspectives of "improving management efficiency" and "maintaining sound management," we will continue to further strengthen internal auditing, risk management and compliance, to further improve the effectiveness of internal control.

Website

Homepage

http://www.sumitomocorp.co.jp

Investor Relations

http://www.sumitomocorp.co.jp/ir/

Publications

Annual Report