- Management Strategy and Achievements

Message from the President: To Our Stakeholders

01 Aiming for Stable and Continuous Growth

We will think outside the box to create completely new business models and achieve stable and continuous growth.

Looking at prospects for global conditions over the longer term, the world's population is projected to increase, driven by emerging countries in Asia and Africa. This is likely to spur rapid growth in demand for resources such as energy, food and water. In Asia, economic development will boost the wages of low-income workers, lifting many into the middle class and driving sustained expansion in emerging markets. As a result, emerging countries will account for a larger share of the global economy, leading to major changes in the global economic environment.

Business models of integrated trading companies have changed drastically over the last 20 years, but in order to continue delivering stable and continuous growth under those conditions, trading companies will need to think outside the box to create completely new business models that anticipate long-term developments in global conditions and the operating environment.

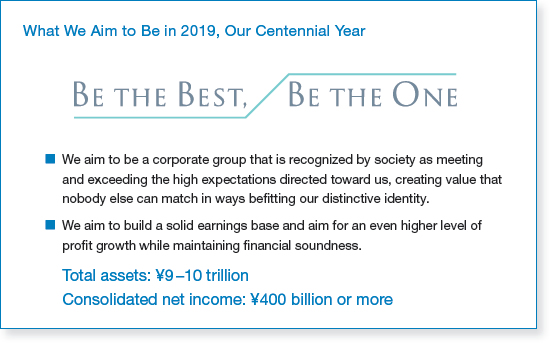

Sumitomo Corporation will celebrate its centennial anniversary in fiscal 2019.

With this major milestone on the horizon, we have set out the Sumitomo Corporation Group's medium-to-long-term vision in "What We Aim to Be in 2019." By realizing this vision, we aim to lay a solid foundation for stable, continuous growth over the next 50 years, 100 years, and beyond following this centennial.

- * Consolidated net income in this report is the same as IFRS profit for the year attributable to owners of the parent.

02 Overview of BBBO2014 and Its Initiatives

We will build a foundation to achieve the even higher level of profit growth envisioned in "What We Aim to Be."

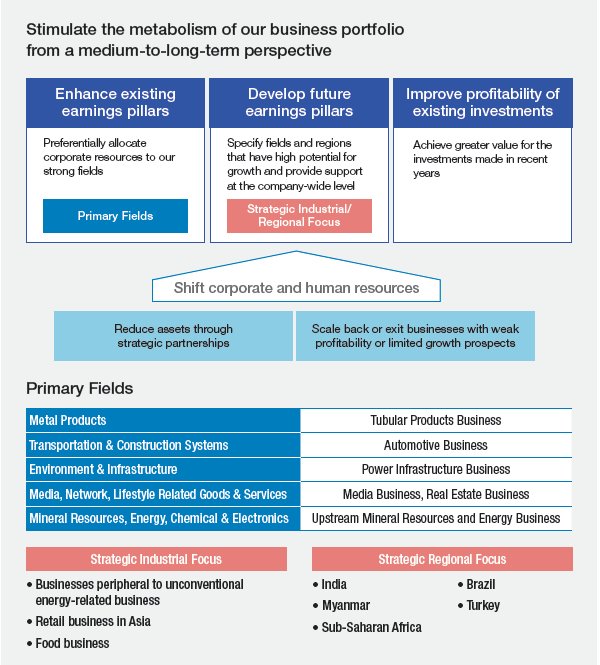

Under our current medium-term management plan, Be the Best, Be the One 2014 (BBBO2014), we have positioned fiscal 2013 and fiscal 2014 as a two-year period to build an operating base that will support even stronger profit growth in order to realize our vision of "What We Aim to Be." Specifically, we are working to thoroughly enhance the Group's earning power by "stimulating the metabolism of our business portfolio from a medium-to-long-term perspective" and by "pursuing and combining our strengths and capabilities."

To stimulate the metabolism of our business portfolio from a medium-to-long-term perspective, Sumitomo Corporation will concentrate corporate resources on

- Making the existing earnings pillars even more robust,

- Undertaking efforts to foster and develop new pillars of earnings for the future, and

- Achieving greater value of existing investment projects in order to strengthen our earning power.

At the same time, in order to secure the necessary corporate resources for the Group, we will carry out reductions and divestitures of businesses that show little potential for profit or growth, and sell or reduce assets on an ongoing basis through strategic partnerships.

"Pursuing and combining our strengths and capabilities" has two key elements. We are actively pursuing the Group's existing strengths and capabilities, while also combining them inside and outside the Group in order to make the most of our integrated strengths.

Specific initiatives include positioning unconventional energy-related business fields as a strategic industrial focus for development by the entire Group, with cross-company working groups formulating strategies and business models and implementing new projects.

The Sumitomo Group has already been involved in a range of unconventional energy-related businesses. In 2009, we became the first Asian company to join a shale gas development project, and our tubular products business, which handles oil country tubular goods (OCTG) and line pipes, is an active participant in various business ventures in the unconventional energy-related field. In this field, we see a growing number of other business opportunities in areas such as water treatment and construction equipment rental. We plan to leverage our expertise accumulated so far to tap into those opportunities and to create new businesses.

03 Interim Evaluation of Fiscal 2013 after a Year of BBBO2014

We have steadily enhanced our earning power as envisioned in "What We Aim to Be."

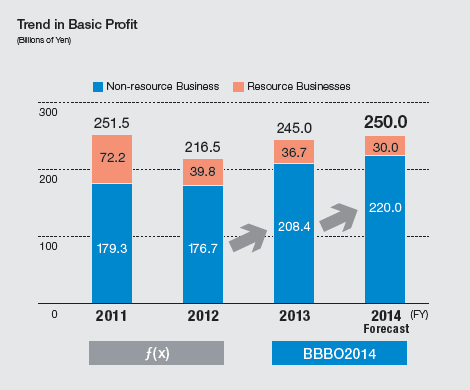

In fiscal 2013, the first year of BBBO2014, we reported consolidated net income of ¥223.1 billion, lower than our initial forecast of ¥240.0 billion. Non-resource businesses such as metal products and transportation & construction systems were firm, but resource businesses were hit by falling prices and we booked an impairment loss on our Australian coal mining project toward March 31, 2014, which were the main factors behind the shortfall in net income.

Also, some investments, including major resource development investments, are taking longer to become profitable than we initially projected. Enhancing the value of these investments will be a key issue going forward.

Basic profit, which strips out impairment losses and other extraordinary items to show the Group's underlying earning power, rose to ¥245.0 billion, exceeding our initial forecast on the back of growth in non-resource businesses. This illustrates the steady progress we have made in enhancing our earning power, which is part of our vision of "What We Aim to Be."

Non-resource businesses reported basic profit of ¥208.4 billion, supported by solid growth among our earnings pillars. This reflected a shift in corporate resources to those earnings pillars and the results of initiatives that we are implementing with strategic partners.

In fiscal 2013, investments and loans totaled ¥290.0 billion, compared with our two-year target of ¥750.0 billion. We focused our resources on the primary fields and on the area of strategic industrial and regional focus.

We also divested and reduced ¥250.0 billion in assets compared with our two-year target of ¥770.0 billion, making steady progress with our policy of "stimulating the metabolism of our business portfolio."

- * Basic Profit = (Gross Profit + Selling, general and administrative expenses (excluding provision for doubtful receivables) + Interest expense, net of interest income + Dividends) x (1 - Tax rate) + Share of profit of investments accounted for using the equity method

04 Initiatives in Fiscal 2014, the Second Year of BBBO2014 for the "Realization of "What We Aim to Be"

We will step up efforts to "stimulate the metabolism of our business portfolio."

Sumitomo Corporation will target ¥250.0 billion in consolidated net income for fiscal 2014, the second year of BBBO2014.

In resource businesses, we expect operating conditions to remain challenging amid low prices. However, in non-resource businesses, we forecast profit growth in operations that have become earnings pillars, and business investments in recent years are likely to start contributing to profits.

In fiscal 2014, we will step up efforts to "stimulate the metabolism of our business portfolio from a medium-to-long-term perspective." By achieving our targets, we will work toward creating solid foundations to realize our vision for "What We Aim to Be."

In November 2013, as part of efforts to make existing earnings pillars even more robust, the tubular products business acquired the Edgen Group, a global distributor of metal and tubular products for the energy industry. In fiscal 2014, we plan to strengthen earning power further by generating synergies between our tubular products value chain—one of the Group's strengths—and the Edgen Group. In the automotive business, we plan to ramp up production at our finished vehicle manufacturing joint venture with Mazda in Mexico and expand our automotive components business to grow the earnings base.

Also, in order to develop future earnings pillars, we signed a comprehensive alliance agreement in the unconventional energy field in 2013 with Gas Technology Institute, one of the leading energy research organizations in the U.S. By bringing together Gas Technology Institute's long track record in shale-related technological expertise and the technology of Japanese companies, we aim to help Japanese corporate interests move into the shale-related industry while also using our global network and know-how to pursue multiple business opportunities. We have already received inquiries from Japanese companies, suggesting a positive outlook for new business development.

In the retail field in Asia, we plan to apply our successful domestic approach to overseas markets in order to tap the voracious consumer demand of the growing middle classes in emerging countries. One example of our approach is Indonesia, where we have been operating car and motorcycle retail financing businesses since 1994. This long track record has helped us build up a vast amount of customer data that is unrivaled in the market. With the arrival of the big data era, customer data has become an extremely important resource for developing retail businesses. In addition, to expanding the retail financing operations further, we are looking to develop a wide range of retail businesses based on this customer data.

Achieving greater value of existing investment projects is an issue we have been tackling since last year, but we need to step up our efforts in this area. In January 2014, we started up commercial production at the Ambatovy nickel project in Madagascar. Operating rates at the project have recently risen to 60-70% (on the basis of nickel production volume). In fiscal 2014 we will focus all our efforts on completing the project by March 2015.

05 Shareholder Returns

We aim to increase dividends per share through medium to long-term profit growth.

Our basic policy is to improve shareholder returns by balancing increases in corporate value with improvements to dividend payments.

The Sumitomo Group has access to numerous investment opportunities worldwide. In order to realize our vision for "What We Aim to Be," we will steadily implement our plan for new investment and loans in BBBO2014 to drive profit growth over the longer term with the aim of increasing dividends per share.

Based on our targets in BBBO2014, we are targeting a consolidated dividend payout ratio of 25%, taking into account relevant factors such as the economic environment and our investment plans. We therefore expect to pay dividends per share of ¥50 in fiscal 2014 if consolidated net income reaches the planned level of ¥250.0 billion.

06 Corporate Social Responsibility (CSR)

For the Sumitomo Corporation Group, CSR is nothing other than putting our Corporate Mission Statement into practice.

One of the credos of Sumitomo's Business Philosophy, passed down for 400 years, says: "Benefit for self and others, private and public interests are one and the same." This means that Sumitomo's business activities must benefit not only Sumitomo's own business, but also society and the nation. The idea behind this credo represents the essence of corporate social responsibility (CSR), and has been carried on in Sumitomo Corporation Group's Corporate Mission Statement, which includes "We aim to constantly stay a step ahead in dealing with change, create new value, and contribute broadly to society," and "To achieve prosperity and realize dreams through sound business activities." For the Sumitomo Corporation Group, CSR is nothing other than putting our Corporate Mission Statement into practice. That is, our CSR activities are planned and implemented as business strategies after considering what we should do and how we should do it as a corporation to help solve social issues through our business activities.

The Sumitomo Corporation Group, with its presence in a large range of industries in countries and regions around the world, is working to obtain an accurate understanding of social issues and identify new needs through dialogue with stakeholders. Using this information, we can offer proposals to resolve those issues by bringing together our unique strengths and capabilities. In other words, we have the power to create value nobody else can match by playing a useful role in society. By leveraging that power to the full extent, we can help lift the living standards of people in the countries and regions where we do business and contribute to economic, industrial and social development, while also boosting earnings and expanding our business activities based on relationships of mutual trust. This is the positive business cycle I want to create.

In March 2009, the Sumitomo Corporation Group signed the UN Global Compact and declared its support for the 10 principles on human rights, labor standards, environment, and anti-corruption. Each employee of the Group will continue to respect these 10 principles, which share the same values as our Corporate Mission Statement, and adhere to our spirit and a strong sense of ethics, to be recognized by society as meeting and exceeding the high expectations directed toward us.

07 Development of Human Resources for the Sumitomo Corporation Group to Grow

Human resources are an important corporate resource that we must develop to underpin our growth.

Human resources are one of the most important corporate resources for integrated trading companies. We recognize that we have to nurture our workforce to support the Group's sustained growth.

We see a growing number of business opportunities in emerging countries in Asia and Africa. To develop our business in those countries, we need talented human resources who can communicate with local people from their perspective, regardless of race, gender, age or nationality, in order to identify needs specific to those countries and regions. This information will help our Company build new business models tailored to each market.

At the same time, it is vital that we cultivate human resources that understand Sumitomo's Business Philosophy and are fully committed to supporting the development of local communities and raising living standards through our business activities. Those are the type of human resources we will focus on nurturing.

08 A Company Able to Grow over the Next 50 and 100 years

Sumitomo's Business Philosophy is a key strength we must pass down, stick to and practice to ensure stable and continuous growth.

Sumitomo's Business Philosophy provides a good reference point for the management approach we need to follow if we want to deliver stable and continuous growth over the next 50 or 100 years.

The Sumitomo group has been in existence for 400 years. Throughout that time, members of the group have inherited the principles of Sumitomo's Business Philosophy, firmly committed to them and put them into practice in their business activities. This has helped Sumitomo remain relevant to society for so long.

I believe those principles are one of the Sumitomo Corporation Group's key strengths.

Every one of our employees puts Sumitomo's Business Philosophy and Sumitomo Corporation Group's Corporate Mission Statement into practice, working with enthusiasm, hunger and persistence to realize our vision for "What We Aim to Be." This commitment will underpin the Group's stable and continuous growth into the future.

In the near term, it will be extremely important to implement the initiatives under BBBO2014.

In fiscal 2014, the final year of BBBO2014, we will step up efforts to thoroughly enhance our earning power, with the whole Group working together to build a solid earnings base that helps us realize our vision for "What We Aim to Be."

I invite you to look forward to the initiatives of the Sumitomo Corporation Group in the period ahead.