- Overview of Operations

-

- At a Glance

- Metal Products Business Unit

- Transportation & Construction Systems Business Unit

- Environment & Infrastructure Business Unit

- Media, Network, Lifestyle Related Goods & Services Business Unit

- Mineral Resources, Energy, Chemical & Electronics Business Unit

- Messages from Regional Organizations

Main Business

- Media, IT and Retail Field

- Lifestyle-related Field

- Construction & Real Estate Field

Organization

- Planning & Administration Dept., Media, Network, Lifestyle Related Goods & Services Business Unit

- Media Division

- Network Division

- Lifestyle & Retail Business Division

- Food & Agriculture Business Division

- Materials & Supplies Division

- Construction & Real Estate Division

- General Construction Development & Coordination Dept.

Media, Network, Lifestyle Related Goods & Services Business Unit

Message from the General Manager

AJapan has a large, stable but mature consumer market. Although it faces both an aging and shrinking population, living standards are high compared with other countries and consumers have trended more toward focusing on value rather than price. Overseas, emerging countries are seeing growth in the middle-income consumers, which is likely to support continued growth in consumption.

In Japan, we are targeting opportunities from the increasingly diverse needs of consumers. We are also stepping up efforts to drive growth by using our know-how in Japan to expand operations overseas.

→ We are targeting growth by transferring our expertise in the mature domestic market to emerging countries in Asia and elsewhere.

A[Summary of Fiscal 2013] Although core businesses such as Cable TV, TV shopping and condominium sales were firm, profit for the year fell ¥14.7 billion to ¥54.4 billion. This decline mainly reflected the partial sale of our stake in Jupiter Shop Channel Co., Ltd. in the previous fiscal year.

In the construction & real estate field, we pushed ahead with a number of urban redevelopment projects, including the redevelopment of the former Kanda campus of Tokyo Denki University and the Ginza 6-chome District project.

Production of a TV shopping program (Thailand)

[Initiatives for FY2014] In the media, IT and retail field, we will focus on developing new TV shopping, e-commerce and drugstore businesses that were set up overseas in the period up to fiscal 2013, the first year of the BBBO2014 medium-term management plan. Jupiter Telecommunications Co., Ltd. (J:COM), jointly operated by Sumitomo Corporation and KDDI CORPORATION, acquired JAPAN CABLENET LIMITED (JCN) in December 2013. J:COM is now working to generate merger synergies from the acquisition. In the lifestyle-related field, we will reinforce upstream operations in the food business in Australia and Asia, and work to extend our value chain into midstream operations. TBC Corporation, our U.S. tire distribution and auto aftermarket retail operation, is steadily implementing a restructuring plan with the goal of achieving a full earnings recovery in fiscal 2015. In the construction & real estate field, we plan to enlarge our portfolio of prime real estate assets while steadily replacing assets in strategic areas in Japan. We will also seek to identify new projects with the potential to generate profits over the medium and long term.

→ We will steadily implement initiatives in a range of fields to drive growth in our earnings base over the medium and long term.

Wild horses can be seen in our forests

AWhile demand for forest resources is growing worldwide, including in the fast-growing economies of Asia, we are building a global sales network that mainly sources timber from the Pacific Rim region. As part of those efforts, we acquired 36,000 hectares of forest in New Zealand. Timber businesses need to work in harmony with the natural environment to ensure long-term timber supplies. We have established a sustainable business model that will ensure the forest is constantly renewed through carefully planned logging and replanting operations. Our forest in New Zealand is certified by the Forest Stewardship Council (FSC®), a global certification body for forests and forest products. The local community has also praised our commitment to sustainable forest management using methods suited to local conditions.

Performance Highlights

| (Billions of yen) | FY2012 | FY2013 | FY2014 forecast |

|---|---|---|---|

| Gross profit | 287.0 | 284.9 | 301.0 |

| Operating profit | 34.0 | 39.5 | - |

| Share of profit of investments accounted for using the equity method | 25.4 | 39.8 | - |

| Profit for the year (attributable to owners of the parent) | 69.1 | 54.4 | 54.0 |

| Total assets | 1,823.2 | 1,871.2 | - |

Business Field Overview

Media, IT and Retail Field

What We Aim to Be ![]()

We aim to expand our earnings base by enhancing our industry-leading operations within Japan, and by growing these businesses overseas.

[Business Environment]

The Japanese consumer market is stable and among the largest in the world. As consumer tastes and lifestyles diversify, e-commerce as a niche has continued to grow in this matured market. Meanwhile, the purchasing power of middle-income consumers in China, Asia and other emerging markets has increased with economic development.

[Strengths and Strategies]

We are developing a portfolio of industry-leading business companies. This includes J:COM, which holds the top share in the Japanese Cable TV market, SCSK Corporation, which provides a full lineup of global IT services, and Jupiter Shop Channel Co., Ltd., Japan's largest TV shopping company. We aim to strengthen these businesses further, and develop them globally.

[Actions for What We Aim to Be]

Launch of a new J:COM

J:COM has secured a dominant position in the Cable TV market after the acquisition and merger with JCN. We plan to expand the business further by integrating brands and services. We also started broadcasting TV shopping programs in Thailand. In the e-commerce business, we are using M&A to drive business expansion.

Lifestyle-related Field

What We Aim to Be ![]()

We aim to provide secure, safe and comfortable diets, lifestyles and communal environments on a global basis.

[Business Environment]

Demand for commodities such as grains, edible oil and meat has increased as diets have diversified and improved following economic development in the emerging markets of Asia and elsewhere. Moreover, this has led to a dramatic increase in timber demand; notably in China, where timber imports have increased more than tenfold in the past 10 years.

[Strengths and Strategies]

Our strengths in the food business field lie in upstream operations such as the grains business in Australia and the banana business in the Philippines. Going forward, we plan to reinforce our position in upstream operations while also expanding our midstream business in consumer markets in Asia and elsewhere.

In the lumber business, we will expand our forest resources in the Pacific Rim region, targeting markets in Asia.

[Actions for What We Aim to Be]

Sugarcane harvesting at the base of our sugar processing operations

In the food business, which has been positioned as a strategic industrial focus for the entire Group, we strengthened the business foundation by increasing our stake in Emerald Grain Pty Ltd, an Australian grain company, from 50% to 100%. In Asia, we are extending our value chain from upstream operations to midstream operations through participation in a flour milling operation in Vietnam and in sugar processing operations in Thailand and China.

Meanwhile, our tire distribution and auto aftermarket retail subsidiary TBC continues to implement measures to drive an earnings recovery.

Construction & Real Estate Field

What We Aim to Be ![]()

We aim to conduct town development that raises international competitiveness and urban redevelopment, while developing sustainable communities with emphasis on themes such as the coexistence of people and the natural environment.

[Business Environment]

Demand for land in urban centers and prime properties has held firm in the Japanese real estate market. In addition, there is a stronger awareness of safety and security with respect to buildings and their maintenance, and environmental friendliness.

[Strengths and Strategies]

As a general property developer, we have long been engaged in the real estate business. We develop high quality properties by positioning urban centers, where demand is strong, as a strategic field, and leveraging our unique integrated corporate strengths to develop buildings and towns that are friendly to both people and the environment. Looking ahead, we will apply our expertise nurtured in domestic operations to business expansion overseas, while also concentrating on the operation of real estate funds involving logistics facilities.

[Actions for What We Aim to Be]

Mixed-use development with Summit, Inc. (CLASSY TOWER Higashi Nakano)

In office building leasing operations, we continued to work on the Kandanishiki-cho 3-Chome Joint Reconstruction Project and the redevelopment of the Kanda area, which includes part of Tokyo Denki University's former Kanda Campus. In condominium sales operations, growing awareness of the CLASSY HOUSE brand supported strong sales. Drawing on the Group's integrated strengths, we started work on the Ginza 6-chome redevelopment project and pushed ahead with construction of CLASSY TOWER Higashi Nakano in Tokyo. Our new real estate fund business, which is focused on logistics facilities, also started full-scale operations.

Project Overview

We have a strong presence in the real estate market as a general property developer with a long track record. Clients value our expertise, which we have built up through mixed-use redevelopment projects such as Harumi Island Triton Square and large-scale retail facilities such as Terrace Mall Shonan. We are now contributing this expertise to the Ginza 6-chome District 10 Category 1 Urban Redevelopment Project.

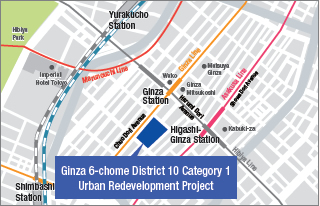

The Ginza 6-chome District 10 Category 1 Urban Redevelopment Project involves the complete redevelopment of a roughly 1.4-hectare site comprising the former site of the Matsuzakaya Ginza department store and an adjacent plot. The project is scheduled for completion in November 2016. The aim of the project is to create a major international retail, business and tourist destination in Tokyo. The building will have around 46,000m2 of retail space, approximately 38,000m2 of office space, with one of the largest floor layouts in Japan, and cultural facilities including the Kanze Nohgakudo Theater. When completed, the building will be one of the largest mixed-use buildings in the Ginza area.

Sumitomo Corporation plans to take an approximate 40% stake in the facility through a special purpose company set up with L Real Estate (part of the LVMH Group) and Mori Building Co., Ltd.

The project will allow us to leverage our integrated corporate strengths, such as our expertise in mixed-use real estate development projects and materials procurement support from our trading company operations. The project's premium, central Tokyo location will also boost our presence in the real estate sector and provide us with new insights into urban redevelopment projects.

Project Overview

| Total project cost: | Approx. ¥83.0 billion (building) |

| Building scale: | Site area approx. 9,080m2; gross floor area approx. 147,900m2; 13 floors above ground, 6 floors below ground |

| Building use: | Stores, offices, Kanze Nohgakudo Theater, district heating and cooling facility and parking |