Global Cases

Creating added value through the global commodities trading business

Japan / Singapore / U.K. / U.S.A.

Monitoring global commodities markets around the clock

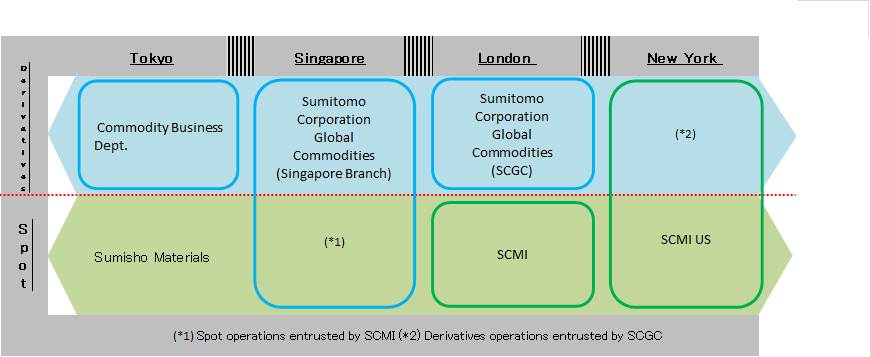

Sumitomo Corporation engages in commodities trading globally from its bases set up in Tokyo, Singapore, London, and New York, which allows access to markets in these locations virtually around the clock on a global basis. Our targets cover a broad range of internationally traded commodities, from precious metals (gold, silver, and platinum group metals), energy (crude oil, gas, petroleum products), non-ferrous metals (copper, nickel, lead, zinc, aluminum), and bulk (coal, iron ore, freight) to soft commodities.

Offering solutions from expertise in derivatives trading

Leveraging our experience and insight built through years of dealing in options and other derivatives(*) in global commodities markets, we offer solutions to internal and external customers. Major needs come from producers for hedging downside risks and others purchasing raw materials for reducing market fluctuation risks. We also provide our customers with relevant market information and value added service, utilizing structured derivatives products.

* "Derivative" is a general term for a range of financial instruments, such as futures, options, swaps and combinations of two or more of these types of trading.

Global development of the commodities trading business

As the earliest Japanese trading company to enter the precious metals spot market, Sumitomo Corporation has developed its business globally over the years, playing an important role in increasing market liquidity. We have expanded our dealing lineup to include scrap and processed metals in addition to rare metals, while launching the precious metals leasing business for needs related to processed and industrial products.

Going forward, we will pursue further growth of the global commodities business, demonstrating our strength in this area with a greater focus on copper and other commodities in addition to precious metals.

April 2017

Keyword

- Japan

- Asia and Oceania

- Europe

- The Americas

- Finance Insurance

- Mineral Resources Group