Current Position—Operating Environment Changes and Review of First Year of Medium-Term Management Plan

Fiscal 2015 was the first year of our medium-term management plan—Be the Best, Be the One 2017 (BBBO2017)—and also a year in which the pace of change in our operating environment picked up. During the year, a strong sense of uncertainty propagated in the external environment, stimulated by the persistence of sluggish resource and energy prices, further deceleration of the Chinese economy, and the emergence of geopolitical risks. Change spread across the globe, as wide-reacting economic spheres were created by the ASEAN Economic Community (AEC) and the Trans-Pacific Partnership (TPP), technology advanced with breakthroughs in the Internet of Things (IoT) and artificial intelligence (AI), and measures to address environmental issues were deployed.

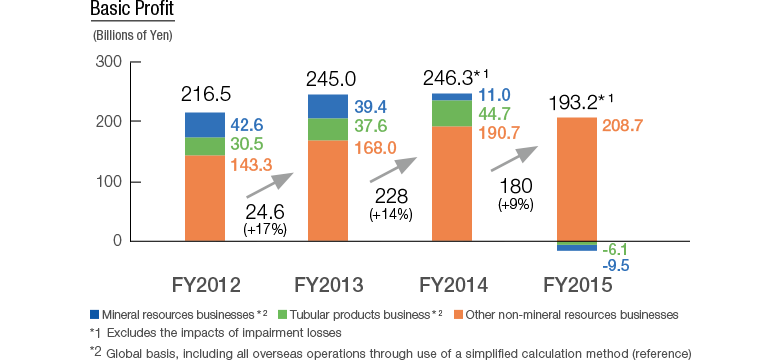

In this environment, non-mineral resources businesses continued to display an uptrend in earnings. However, due to the impact of a drop in resource and energy prices, a total of ¥195.1 billion in impairment losses was posted, mainly in upstream resources projects. As a result, consolidated net income amounted to ¥74.5 billion, compared with our goal of ¥230.0 billion. It is most unfortunate that we must once again worry our stakeholders, and, as a representative of Sumitomo Corporation's management, I am fully aware of the gravity of this situation.

Meanwhile, basic profit* in non-mineral resources businesses totaled ¥208.7 billion in fiscal 2015, continuing to increase thanks to growth of our core businesses, such as the media, network-related business as well as the overseas power infrastructure business and the automobile manufacturing, financing, and leasing businesses. This increase can be seen as a success of the efforts to boost our earnings capacity that we have advanced to date.

- *Basic profit = (Gross profit + Selling, general and administrative expenses (excluding provision for doubtful receivables) + Interest expense, net of interest income + Dividends) x (1 . Tax rate) + Share of profit (loss) of investments accounted for using the equity method

On the qualitative side of operations, we worked to improve decision-making processes.

To this end, the Management Council was designated as the highest decision-making body at the operational execution level, and we strengthened the monitoring functions of the Board of Directors. We also revamped our risk management system in which large-scale investment projects are examined at multiple times at various stages throughout the investment process.

Revision of Three-Year Medium-Term

Management Plan BBBO2017

Based on changes in the operating environment, we revised the quantitative performance targets of BBBO2017 that were announced in March 2015. The main points with regard to these revisions are as follows.

1. Revision of Profit Targets

As the slump in the prices of resources and energy has been prolonged, the recovery of our mineral resources businesses and tubular products business are expected to be delayed, although we anticipate a generally solid performance in non-mineral resources businesses.

Therefore, we have changed our consolidated net income target for fiscal 2017 from ¥300.0 billion or more to ¥220.0 billion or more.

2. Revision of Cash Flow Targets

We have changed the target from seeking to achieve a positive post-dividend free cash flow on a three-year basis to pursuing a positive free cash flow of ¥500.0 billion, and we intend to use the funds recovered for repaying interest-bearing debt.

Strengthening of Financial Position, Asset Replacement, and Growth Investments

In consideration of our performance in fiscal 2015 as well as the recent deterioration of the operating environment, we have determined that now is the ideal time to further strengthen our financial position. We have thus decided to accelerate the asset replacement initiatives we have been implementing until now to create additional cash for use in repaying interest-bearing debt. By fortifying our position in this manner, we should be able to carry out managerial functions without being overly influenced by external conditions, even if the operating environment deteriorated further in the future. Conversely, if the environment improved, we would be poised to expand our operating foundations, ensuring that we are able to take advantage of any opportunities that might appear. As a result, we have greatly increased our target for funds recovered through asset replacement, and we are now aiming to secure roughly ¥900.0 billion via this method during the three years of the plan. At the same time, we will invest around ¥1.0 trillion over this period, primarily in growth fields such as Automobile & Transportation System-related, Lifestyle and Information Services, and Infrastructure. Our operating environment is currently changing at an unprecedented pace. Amidst such change, the scope of our business is expanding, and the growth fields available for us to target are transforming. For this reason, if we are to ensure robust growth going forward, it will be crucial for us to break out of the confines of existing frameworks. From such a liberated perspective, we must boldly shift management resources to fields where we can expect more substantial growth and to new projects with the potential to support the Company's future development.

Please refer to “Promoting Our Medium-Term Management Plan—BBBO2017” for details.

Shareholder Returns

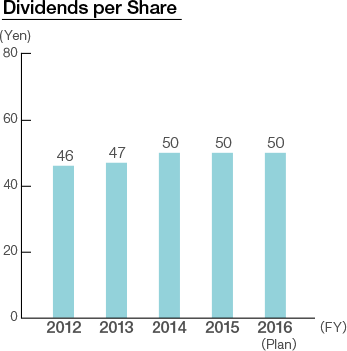

Sumitomo Corporation's basic policy is to provide shareholders with stable dividends over the long term, and we also aim to raise per share dividend payments by pursuing profit growth in the medium-to-long term.

We have set ¥50 per share as the lower limit for dividend payments over the period of BBBO2017.

Dividend amounts for each fiscal year will be decided based on considerations of basic profit and cash flow levels and with a consolidated dividend payout ratio of 25% as our target. In fiscal 2016, we intend to issue dividend payments of ¥50 per share in accordance with the dividend policy of BBBO2017.

Sumitomo Corporation's Centennial Anniversary, and 50 and 100 Years Beyond

In 2019, we will celebrate the centennial anniversary of the founding of Sumitomo Corporation. In marking this anniversary, as we look back on the path that we have walked with the stakeholders who have supported us over 100 years, simultaneously looking to the next 50 and 100 years, we will move forward to ensure that the Sumitomo Corporation Group can grow stably and continually. Just as Sumitomo survived for 400 years thanks to its business philosophy, I believe that we should practice this same business philosophy to accomplish growth. One of the core concepts of this philosophy is embodied in the phrase “Benefit for self and others, private and public interests are one and the same.” To put it another way, Sumitomo's business activities must benefit not only Sumitomo's own business, but also the nation and society. Sumitomo's ability to continue operating for 400 years was due to its embodiment of this principle, seeking not just its own profits but rather aspiring to always be a company that is useful to society, contributes to society, and is respected by society. I am confident that we will be able to continue growing over the next 50 and 100 years if all of us at Sumitomo Corporation take Sumitomo's philosophy to heart and do our best to benefit the stakeholders with whom we interact.

To commemorate Sumitomo Corporation's centennial anniversary, we plan to relocate our Head Office to Otemachi, in Chiyoda-ku, Tokyo, in fall 2018. The new Head Office location will provide increased convenience, allowing us to build stronger relationships with customers and business partners. At the same time, as we use the relocation as an opportunity to drastically reform employees' working styles, we will create an office environment that contributes to efficiency while stimulating creativity.

In Closing

Our operating environment is currently characterized by accelerated change on a global scale, and there can be no doubt that the amount of business opportunities available to us is growing. In this environment, as we demonstrate the strengths and functions that are unique to Sumitomo Corporation along with Sumitomo's philosophy and the Management Principles, we will stay a step ahead in dealing with change and provide resolutions to the issues that our customers and business partners face while creating value. By advancing BBBO2017, we aim to boost earnings capacity and return to the growth track to ensure stable and continual growth over the next 50 and 100 years. The entire Sumitomo Corporation Group will unite to further us on this path.

I humbly ask for your continued understanding and support of our efforts.

August 2016

Kuniharu Nakamura

President and CEO