Metal Products Business Unit

Organization

- Planning & Administration Dept., Metal Products Business Unit

- Steel Sheet & Construction Steel Products Division

- Metal Products for Automotive & Railway Industry Division

- Light Metals & Specialty Steel Sheet Division

- Tubular Products Division

Performance

Highlights

(Billions of yen)

| FY2011 | FY2012 | FY2013 forecast |

|

| Gross profit | 66.9 | 65.2 | 77.0 |

| Operating profit | 19.4 | 18.2 | - |

| Share of profit of investments accounted for using the equity method | 5.0 | 5.6 | - |

| Profit for the year (attributable to owners of the parent) | 15.3 | 15.2 | 21.0 |

| Total assets | 648.2 | 671.2 | - |

Message from the General Manager

Kazuhisa Togashi

General Manager,

Kazuhisa Togashi

General Manager, Metal Products Business Unit

The business environment for metals is changing in many ways as a result of consumption expanding in the emerging markets, Japanese manufacturers shifting their operations overseas, and companies reorganizing and consolidating within the industry.

We will achieve our growth strategy of strengthening our ties with global business partners and expanding value chains globally in the tubular products, steel sheet-related, and non-ferrous products & metals fields by harnessing our diverse functions efficiently. To this end, we will actively develop new business models to enhance the metal products business.

For instance, we will expand our tubular products value chain in the energy field. In the steel-sheet related area, we will position ourselves as a significant supplier of metal products for transportation equipment with a presence in fields such as railways and automobiles. Moreover, one of our focuses in the non-ferrous metal products field is to expand our aluminum products value chain as a global player.

Business Unit Overview

Our business encompasses various metal products, including steel products such as steel sheets, tubular products, and non-ferrous metal products such as aluminum and titanium. We have an extensive value chain that satisfies the diverse needs of customers in a broad range of fields. In the steel sheet-related field, we provide just-in-time delivery services for steel sheet products mainly to automotive and home appliance manufacturers via our worldwide steel service center network, which provides functions including procurement, inventory management, and processing. In the tubular products field, we are enhancing our functions as a total service provider by developing oil field services in addition to our own proprietary supply chain management (SCM) system for oil and gas companies. In addition, in the non-ferrous products & metals field, our priority is to expand our production and sales locations for aluminum ingot and aluminum sheets.

Fiscal 2012 Results

Business Performance

The North American tubular products business delivered a strong performance. However, overseas steel service center operations saw profit decline mainly due to impact from Chinese economic deceleration and the European financial crisis. As a result, profit for the year edged down ¥0.1 billion year on year to ¥15.2 billion in fiscal 2012.

Main Investment and Loans

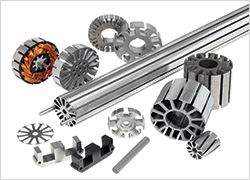

- Acquisition of Kienle + Spiess GmbH (K+S), a German motor core components manufacturing and sales company

- Participation in the specialty steel processing and sales business of Mukand Limited in India

- Start of production at a small-diameter seamless steel pipe manufacturing business in the U.S.

Business Field Overview: What We Aim to Be

Steel Sheet-related Field

Motor cores are used in industrial motors, electric vehicles, hybrid cars, and wind power generation.

Motor cores are used in industrial motors, electric vehicles, hybrid cars, and wind power generation.

- Business Environment

- In emerging countries, robust consumer spending is fueling growing demand for automobiles, motorcycles, home appliances, and building materials. Further, a shift to railway transportation in developed countries and railway infrastructure development in emerging countries are expected to further boost demand for the steel products used as raw materials for this infrastructure.

- Strengths and Strategies

- In the steel sheet business, we will sharpen the competitive edge of our steel service center network spanning 36 companies in 14 countries worldwide, primarily in Asia and China, in step with changes in the business environment. In the transportation equipment business, which includes railway wheels, axels and automotive crankshafts, we will strive to grow market share by developing manufacturing and sales sites in regions around the globe.

- Actions for What We Aim to Be

- Sumitomo Corporation acquired all the shares of K+S, one of Europe’s largest motor core manufacturing and sales companies. Motor cores are used in products such as industrial motors, electric vehicles, hybrid cars, and wind-generated power. Demand for motor cores is expected to grow on the back of environmental measures and awareness of rising energy costs.

Also, we participated in the specialty steel processing and sales business in India where rising demand is projected along with the increase in motorcycles and automobiles.

Tubular Products Field

Small-diameter seamless steel pipe manufactured at Vallourec Star, LP in the U.S.

Small-diameter seamless steel pipe manufactured at Vallourec Star, LP in the U.S.

- Business Environment

- Demand for tubular products, including OCTG and line pipes for transporting oil and gas, is anticipated to increase over the medium to long term, in response to heightened demand for energy mainly in emerging countries.

- Strengths and Strategies

- Our business in the tubular products field boasts an industry-leading network and trading volume. This has been achieved by developing operations that demonstrate various value-added functions globally. For example, we have built supply chain management systems around the world, based on 23 contracts in 14 countries, providing integrated services ranging from ordering of tubular products to inventory management, processing, inspection, transportation and maintenance. We intend to continue enhancing the tubular product value chain we have developed so far, with a view to expanding our earnings base.

- Actions for What We Aim to Be

- In North America, we are engaged in a seamless steel pipe manufacturing business, as shale gas and oil development is expected to continue growing in the future. In addition to a medium-diameter seamless steel pipe mill, we have invested in a small-diameter seamless steel pipe manufacturing business as part of steps to reinforce our supply framework.

In addition, we aim to further enhance our tubular products value chain by bolstering operations in fields related to the OCTG business—namely oilfield equipment, material, and services.

Non-Ferrous Products & Metals Field

Electric furnaces for smelting aluminum ingots at Press Metal Berhad in Malaysia

Electric furnaces for smelting aluminum ingots at Press Metal Berhad in Malaysia

- Business Environment

- The scope of usage and application of aluminum, titanium and other non-ferrous metal products has broadened in recent years, with demand for them expected to grow further. This market should continue to expand, given the strong need to reduce the weight and improve the fuel economy of automobiles, aircraft and other transportation equipment.

- Strengths and Strategies

- In the aluminum business, we boast one of the highest transaction volumes in aluminum sales among Japanese general trading companies. We aim to build a value chain from smelting operations upstream to rolling mills midstream to expand our business base further, and accelerate the development of production locations near the growing global market for aluminum.

- Actions for What We Aim to Be

- In Malaysia, we are developing aluminum smelting operations with Press Metal Berhad, the country’s biggest aluminum extrusion products company.

Additionally, we worked in partnership with other companies to acquire a rolled aluminum sheet manufacturing and sales company in the U.S., and are developing an aluminum can materials business focused on the Americas.

CSR Through Business Activities

Global Safety Management

The OCTG inventory operation team in Sakhalin

The OCTG inventory operation team in Sakhalin

In the Metal Products Business Unit, all subsidiaries and associated companies document their safety activities in accordance with the Group’s Safety Manual, Safety and Hygiene Management Guidelines, and Work handbooks, and every employee is appropriately trained on safety in the workplace. This vigilance helps prevent accidents before they happen.

The Tubular Products Division manages and operates the tubular products businesses throughout the world. The division has set a “Zero Harm” target, and has established a global safety network and implemented common and standardized safety management systems. The target, network and systems focus on efforts to continually improve operational management and maintain safe working environments. The division is using this network to facilitate timely sharing of safety information, greatly improve inter-regional communication, strengthen safety systems and promote safety measures. During the fiscal 2012, members of the network visited business and operational sites in North America, Europe, Asia-Pacific, the Middle East and the Far East. At each location they evaluated the status of safety management and worked with the employees there to identify opportunities for improvement. The Sakhalin operation achieved a seventh consecutive year without a lost time accident.